On April 21, 2021, the Eleventh Circuit Court of Appeals issued a decision in the case of Hunstein vs. Preferred Collection and Management Services. The Court found that the debt collector’s use of a third-party mail vendor violated the Fair Debt Collection Practices Act. This ruling resulted in an increase in lawsuits against debt collectors (third-party agencies) and raised serious compliance concerns for creditors under the Florida Consumer Collections Practices Act.

On April 21, 2021, the Eleventh Circuit Court of Appeals issued a decision in the case of Hunstein vs. Preferred Collection and Management Services. The Court found that the debt collector’s use of a third-party mail vendor violated the Fair Debt Collection Practices Act. This ruling resulted in an increase in lawsuits against debt collectors (third-party agencies) and raised serious compliance concerns for creditors under the Florida Consumer Collections Practices Act.

On Wednesday, November 17, 2021, the Eleventh Circuit Court of Appeals issued an order vacating the previous decision. Additionally, the Court issued an order to rehear the case before the full Court panel. The original case was heard before a panel of three judges.

The case was reheard before the full panel of judges for the Eleventh Circuit Court of Appeals. The court issued their latest opinion on September 9, 2022. The court has reversed the original decision. The court found that the Plaintiff did not have standing to bring the lawsuit because the Plaintiff had not suffered a “real” injury. The court focused on the fact that the Plaintiff had not suffered any harm. It is important to note that the court did not get to the issue of whether the use of third-party mail vendor violated the FDCPA.

The effect of the Court’s action is that the prior opinion of the court is no longer valid and does not have authority over lower courts. The Plaintiff could seek to appeal this decision to the U.S. Supreme Court, or the Plaintiff could refile the suit in state court in Florida. Florida law provides a different standard for standing that may allow the case and allegations to move forward. We will continue to monitor this matter and will provide updates as this case moves forward.

On Friday, July 29, 2022, the CFPB and Justice Department issued a Joint Letter reminding auto lenders of their responsibilities to recognize important legal protections for military families under the Servicemembers Civil Relief Act (SCRA). This letter comes months after the CFPB issued a compliance bulletin on repossessions. The CFPB also addressed repossession compliance issues in its Spring 2022 Supervisory Highlights.

On Friday, July 29, 2022, the CFPB and Justice Department issued a Joint Letter reminding auto lenders of their responsibilities to recognize important legal protections for military families under the Servicemembers Civil Relief Act (SCRA). This letter comes months after the CFPB issued a compliance bulletin on repossessions. The CFPB also addressed repossession compliance issues in its Spring 2022 Supervisory Highlights.

On April 21, 2021, the Eleventh Circuit Court of Appeals issued a decision in the case of Hunstein vs. Preferred Collection and Management Services. The Court found that the debt collector’s use of a third-party mail vendor violated the Fair Debt Collection Practices Act. This ruling resulted in an increase in lawsuits against debt collectors (third-party agencies) and raised similar compliance concerns for creditors under the Florida Consumer Collections Practices Act. A copy of our original summary of this Court opinion can be found

On April 21, 2021, the Eleventh Circuit Court of Appeals issued a decision in the case of Hunstein vs. Preferred Collection and Management Services. The Court found that the debt collector’s use of a third-party mail vendor violated the Fair Debt Collection Practices Act. This ruling resulted in an increase in lawsuits against debt collectors (third-party agencies) and raised similar compliance concerns for creditors under the Florida Consumer Collections Practices Act. A copy of our original summary of this Court opinion can be found

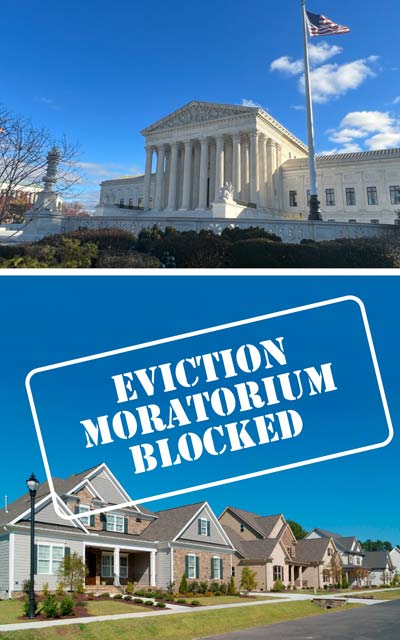

On August 26, 2021, the United States Supreme Court in a 6-3 ruling, blocked the latest Centers for Disease Control (CDC) Eviction Moratorium, finding that the CDC exceeded its authority. A majority of the Court held that only Congress can allow for such a ban on evictions.

On August 26, 2021, the United States Supreme Court in a 6-3 ruling, blocked the latest Centers for Disease Control (CDC) Eviction Moratorium, finding that the CDC exceeded its authority. A majority of the Court held that only Congress can allow for such a ban on evictions.

In determining whether a county is experiencing substantial or high transmission levels, the CDC intends to look at the number of new cases reported per 100,000 residents over a seven-day period and the positivity rate of that county. If the number of new cases in a county in the prior seven days, divided by the population of the county, then multiplied by 100,000 is between 50.99 and

In determining whether a county is experiencing substantial or high transmission levels, the CDC intends to look at the number of new cases reported per 100,000 residents over a seven-day period and the positivity rate of that county. If the number of new cases in a county in the prior seven days, divided by the population of the county, then multiplied by 100,000 is between 50.99 and

Yesterday, the Consumer Financial Protection Bureau (CFPB) announced that the two final rules under the Fair Debt Collection Practices Act will take effect on November 30, 2021. Previously, the CFPB issued a proposal to move the effective date to January 29, 2022, to give third-party debt collectors more time to implement the new rule due to the pandemic. The CFPB has now determined that an extension is unnecessary. While the rule is aimed at third-party debt collection, the rule does have some impact on creditors who work with third-party debt collectors.

Yesterday, the Consumer Financial Protection Bureau (CFPB) announced that the two final rules under the Fair Debt Collection Practices Act will take effect on November 30, 2021. Previously, the CFPB issued a proposal to move the effective date to January 29, 2022, to give third-party debt collectors more time to implement the new rule due to the pandemic. The CFPB has now determined that an extension is unnecessary. While the rule is aimed at third-party debt collection, the rule does have some impact on creditors who work with third-party debt collectors.

The Federal Housing Finance Administration (FHFA), an independent federal agency that oversees Fannie Mae and Freddie Mac, has announced that it is extending its moratorium on residential mortgage foreclosures through July 31, 2021. This moratorium was scheduled to expire on June 30, 2021. This applies to all residential mortgage loans that are owned by Fannie Mae and Freddie Mac, and prevents any servicer from seeking to file a foreclosure or complete a foreclosure on any residential property that is occupied.

The Federal Housing Finance Administration (FHFA), an independent federal agency that oversees Fannie Mae and Freddie Mac, has announced that it is extending its moratorium on residential mortgage foreclosures through July 31, 2021. This moratorium was scheduled to expire on June 30, 2021. This applies to all residential mortgage loans that are owned by Fannie Mae and Freddie Mac, and prevents any servicer from seeking to file a foreclosure or complete a foreclosure on any residential property that is occupied.

On April 21, 2021, the Eleventh Circuit Court of Appeals issued a decision in the case of Hunstein vs. Preferred Collection and Management Services. This opinion raises several issues and, in our opinion, could lead to litigation claims against debt collectors and creditors, including Credit Unions.

On April 21, 2021, the Eleventh Circuit Court of Appeals issued a decision in the case of Hunstein vs. Preferred Collection and Management Services. This opinion raises several issues and, in our opinion, could lead to litigation claims against debt collectors and creditors, including Credit Unions.